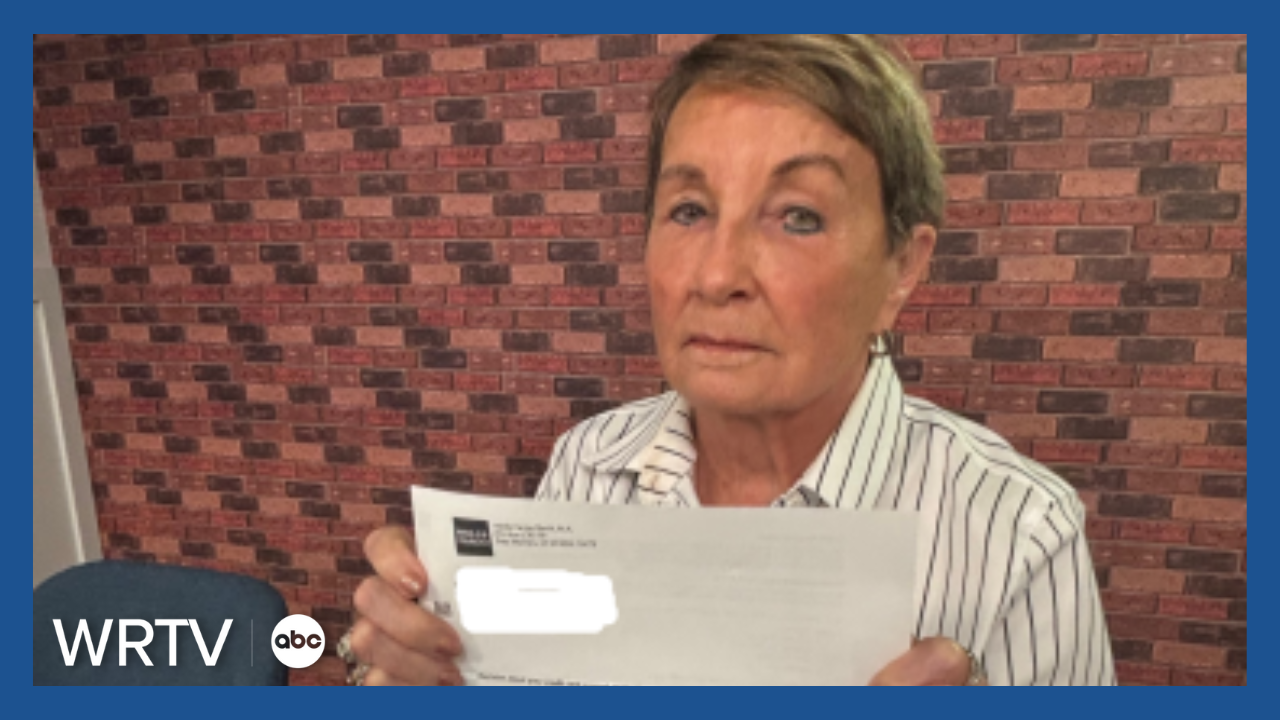

INDIANAPOLIS— Judi LeMond of Indianapolis is alive and well at 87 years old.

But according to a letter she received in the mail, she’s dead.

“I mean, I am 87, so I probably ought to be deceased, but I’m not," said Lemond.

LeMond contacted WRTV Investigates for help.

“I was frustrated. It scared me,” said LeMond. “If something serious would happen and I might need credit, I might not be able to get it."

Earlier this year, LeMond applied for a credit card with Wells Fargo hoping to get more cash back on her purchases, but the bank denied her application.

“Credit bureau report shows consumer status as deceased,” read the Wells Fargo denial letter.

The letter went on to say Wells Fargo’s decision was based on a consumer report from Equifax, one of the nation’s three credit bureaus.

"I have tried to get to Equifax,” said LeMond. “It routes you here and there."

WRTV Investigates contacted Equifax and Wells Fargo, but both companies told us they could not discuss LeMond’s case with us because of consumer privacy.

Both Equifax and Wells Fargo told us they would contact LeMond directly.

After WRTV Investigates got involved, LeMond says Wells Fargo called her and told her when she filled out the credit card application, she had one digit off on her social security number—which was the identity of a dead person.

LeMond denies making this mistake.

Money Management International, a national credit counseling nonprofit, tells us that a consumer error is just one of many reasons why this can happen.

“Typically, this means there was some sort of a clerical error,” said Thomas Nitzsche, Vice President of Public Relations at Money Management International.

Nitzsche says this can happen to anyone, regardless of their credit score or financial situation.

“Usually this sort of thing happens with a legitimate death,” said Nitzsche. “Someone with a similar name, identical birth date, co-holder on an account who became deceased. When you’re processing so many hundreds of millions of credit reporting information every month, mistakes are bound to happen."

If this happens to you:

- Double check all of your information is entered correctly

- Contact the creditor and tell them you’re alive

- Ask the creditor where they got the information

- Contact all 3 credit bureaus—Experian, Equifax and Transunion

- Contact the Social Security Administration

- You may need to provide evidence you’re alive such as ID

"You definitely want to take care of that because if you apply for credit in the future, you’re likely going to be declined,” said Nitzsche. “It can create more serious problems for you down the road.”

Judi LeMond says because of this deceased debacle, she can’t switch from Xfinity to T-Mobile.

“I don’t get it,” said LeMond. “I have zero credit problems. What are they doing to people that have to have credit?"

She will go on living and laughing about what happened.

“For a dead person, I feel really good,” said LeMond.

Remember, you are entitled to a free credit report every year.

The correct website to obtain your free credit report is AnnualCreditReport.com.

FULL EQUIFAX STATEMENT:

Consumers should proactively monitor their credit reports so that they are more aware of what lenders may see and so that they can detect any potentially inaccurate or incomplete information provided to the credit bureaus. A consumer can access their credit report from Equifax, Experian and TransUnion [transunion.com] at no charge every week or request a free copy through AnnualCreditReport.com [annualcreditreport.com].

If a consumer reviews their credit report and finds their personal information to be inaccurate or incomplete, they may file a dispute online but must do so with each of the three U.S. National Credit Reporting Agencies. A consumer can file a credit dispute [equifax.com] with Equifax via MyEquifax [my.equifax.com].

Equifax continues to invest resources and collaborate with stakeholders to make our process as accessible and accurate as possible while aiming to deliver the highest quality and effectiveness in every interaction we have with consumers.