BARGERSVILLE — Donald Newton moved south of Indianapolis to enjoy the peace and quiet.

Finding a home was a challenge with a tight housing market forcing families to engage in bidding wars to get the property of their choice.

Newton bought his home in the Somerset subdivision in Bargersville in 2018. The neighborhood with uniformly trimmed lawns and winding sidewalks is perfect for him to walk his dog.

In 2021, his home was assessed at $315,000. One year later, he received a new notice of assessment as of Jan. 1, his home value is now $474,500.

"I was shocked. I was shocked and then I got mad and them I thought what am I going to do about it," Newton said.

Newton fears the new assessment will him out of his home.

"50 percent increase," Newton said. "50 percent. Not 5, 50% "

Shawn Wilkins also lives in Somerset neighborhood. His home value went from $383,700 in 2021 to $566,300 this year.

Wilkins is a family man who's concerned about his budget as he like most Hoosiers are looking for ways to deal with the burdens of inflation impacting everything from food and travel.

Newton and his wife have already cut back, especially on entertainment.

"We're already cutting back because groceries being higher," Newton said.

Many of Newton's neighbors are also receiving notices from the Johnson County Assessor.

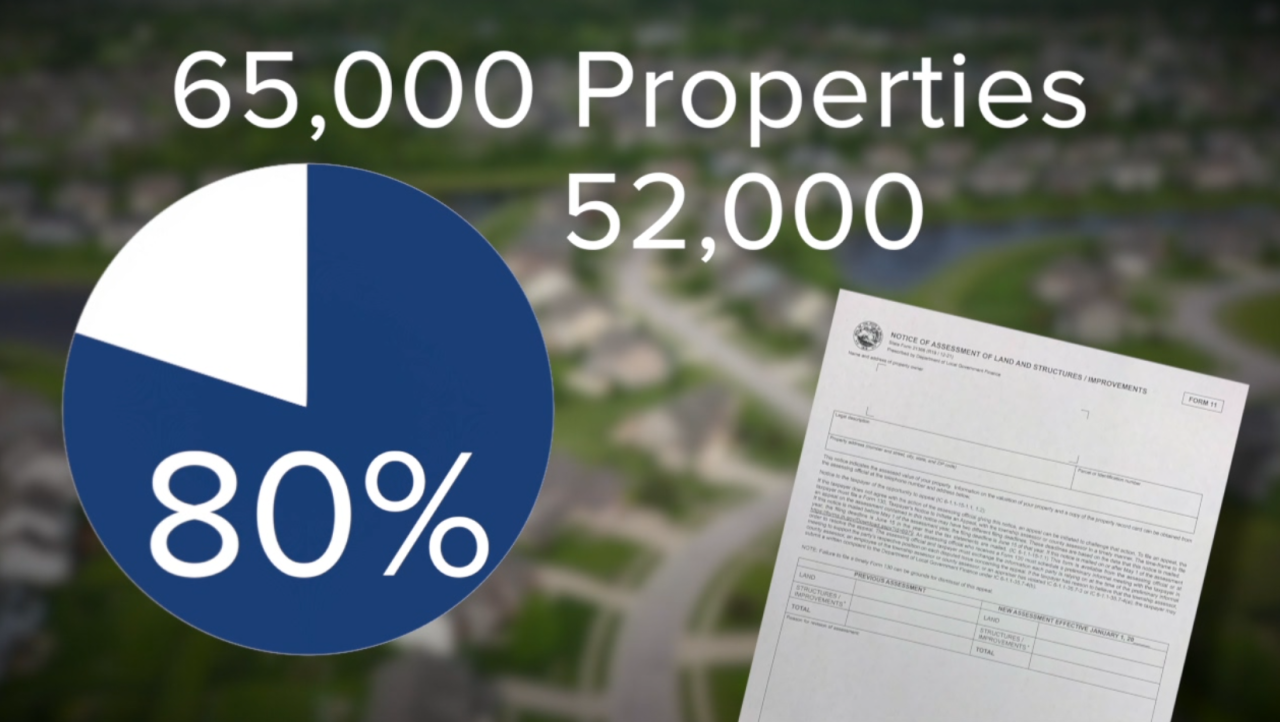

Mark Alexander says out of 65,000 properties, 52,000 received a notice that their assessment had gone up.

"People will respond to this and say 'I didn't do anything. I didn't improve the property. Why raising mine?' We go into the explanation we didn't just change yours. We changed other houses in the neighborhood that are similar to yours based on a sale that occurred last year," Alexander said.

The assessor said his team is ready to receive what is known statewide as Form 130 or the taxpayer's notice to initiate an appeal due on June 15 to your county assessor.

Many people in Johnson County, for example, choose not to challenge the government, though there is a possibility that their assessment could be changed.

You may feel that the two-page appeals form may involve many moving pieces. But the building blocks to a successful challenge involves you taking the first step to make sure your home value is correct from the foundation to the roof.

You can view an example of the forms below:

Alexander said the results of an appeal can result in three things:

- Assessments can be decreased

- Assessment stays the same

- Can go up due to improvements

For homeowners, the biggest concern is how the new assessment will impact their tax bill next May and November 2023.

"If your assessment went up $100,000, the most it can go up is $1,000 a year because of a tax cap for a homestead property," Alexander said.

Newton has lived in a number of other states including Michigan, Tennessee and Texas.

This situation at this magnitude is a first for him.

"Over my lifetime, I've never had property tax increase that high. I will appeal," Newton said.

Homeowners whose assessment claim is rejected on the first request have a series of appeals they can seek to challenge their home value.

Several appeals can still be made on the county level and can at the highest level can be taken to the state's Tax Court and could be reviewed by the Indiana Supreme Court.

-

IFD seeking information on fire at southside Indy restaurant

Fire investigators are asking for the public's help as they continue processing the scene of a fire that damaged Jakes Pub on Indy's south side early Wednesday morning.

Colorectal cancer leading cause of cancer deaths in people under 50

Colorectal cancer is now the leading cause of cancer-related deaths in people younger than 50, according to medical experts.

Parents of transgender Hoosiers share impact of BMV gender marker rule change

The Indiana Bureau of Motor Vehicles will no longer provide customers with the option to change their gender on their Indiana credential by using a court-ordered gender change or physician's statement

North side shooting leaves person in serious condition

A person is reported to be in serious condition following a shooting on the north side of Indianapolis on Thursday.